The current market and how we plan to enter it

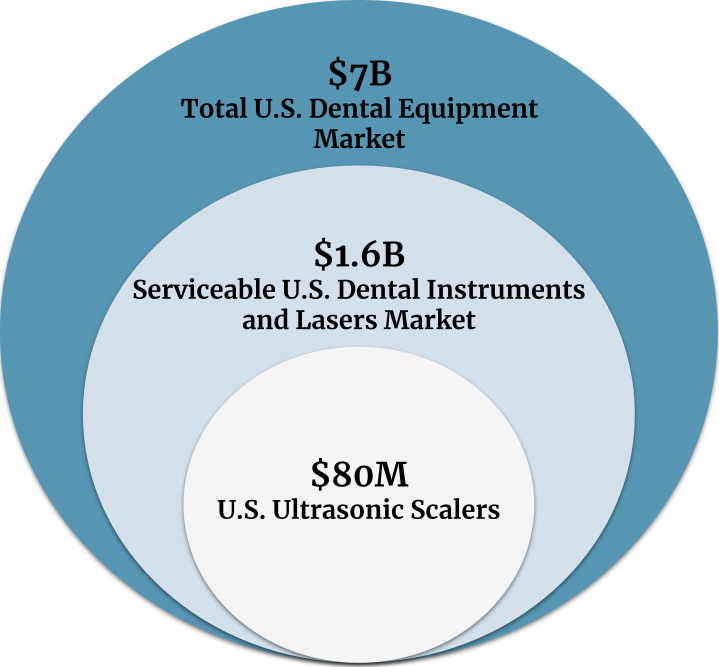

It is estimated that the market size will increase incrementally by 41.39 million dollars globally between 2018 and 2023. The market will continue to increase at a compound annual growth rate of 5%.

There are eight major players in the dental equipment market: DENTSPLY International, Magpie Tech Inc., Den-Mat Holdings LLC., Coltene Whaledent Pvt. Ltd., Aseptico Inc., Deldent Ltd., Kerr Endodontics, and DBI America Corp. With the increasing number of dental practitioners in developed and developing countries, the ultrasonic scaler market will continue to grow. Dentaero believes that our product will disrupt the market by partnering with one of these companies because our product solves many issues that other devices are unable to.

Our target market is geared toward dentists and hygienists since ultrasonic scalers are mainly used for professional dental cleaning. To promote our customer market, we will demonstrate our product to dental schools in Southern California. This demonstration brings awareness of our product to upcoming dentists who can use it in their practice.

We plan to sell our product design and patent to a partner dental equipment company and negotiate royalty fees based on the number of units sold and gross sales. The revenue model Dentaero will use is the razor-razor blade model, where the housing unit will be sold as an add-on to the core scaler components. The partner dental company will seek supply contracts with various dental clinics and sell the disposable housing unit and the one-time purchase of core scaler components. Building a revenue model based on gross sales will naturally lead to a lower percentage share, but it protects our revenue model from exploitation.

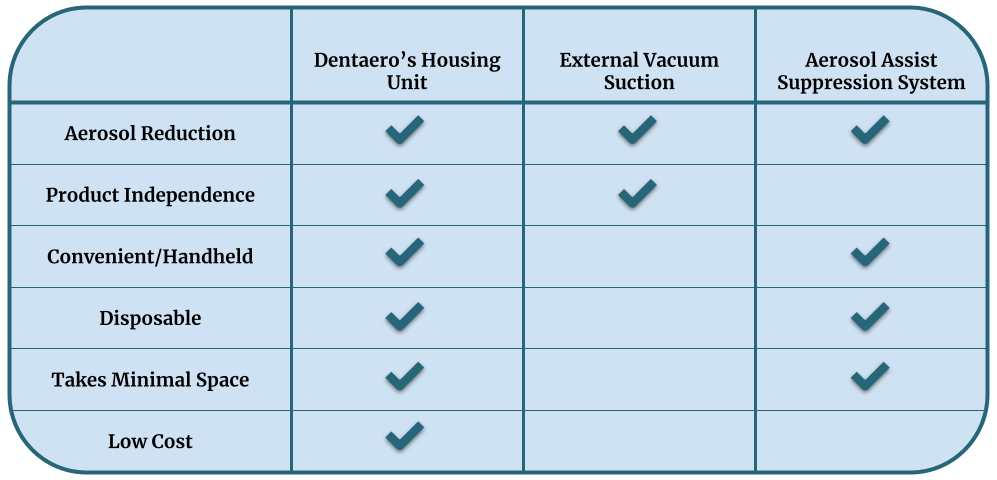

Although there are current devices to decrease aerosol particles from dental clinics, little has been done to improve the process. We have performed a competitive analysis on two other devices on the market (external vacuum suction and aerosol assist aerosol suppression system) alongside our device. When compared to the extraoral vacuum suction device, DHU differentiates itself by being convenient and disposable while taking up minimal dental workspace. Although the aerosol assist system is convenient, disposable, and ergonomically sound, ours differentiates itself by specifically addressing both teeth overheating problems and an overcrowded dental workspace.